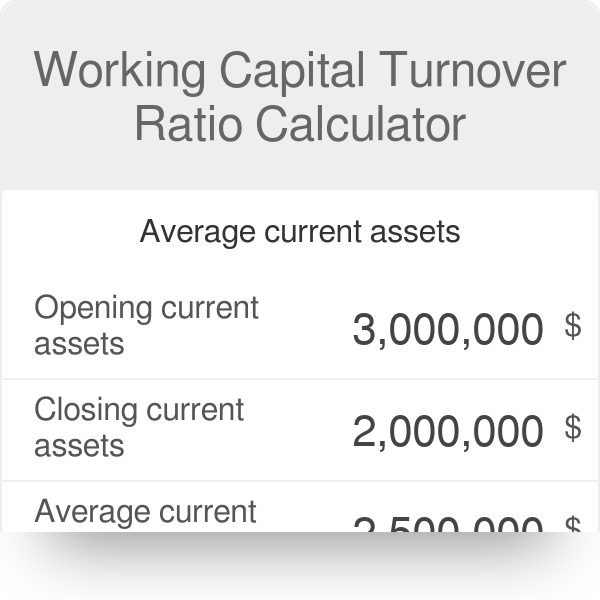

working capital turnover ratio calculator

4mm Our table lists each of the years in the rows and then has three columns. Negative Working Capital.

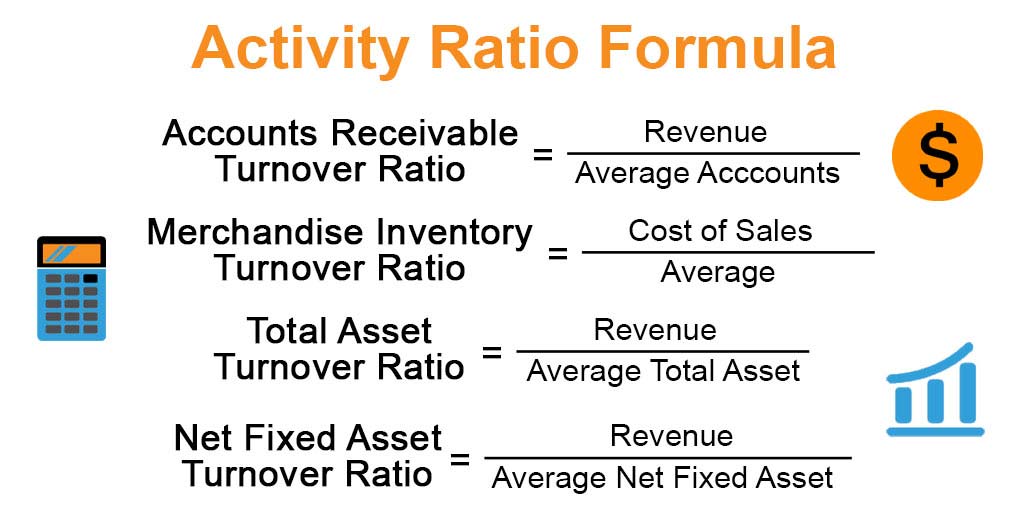

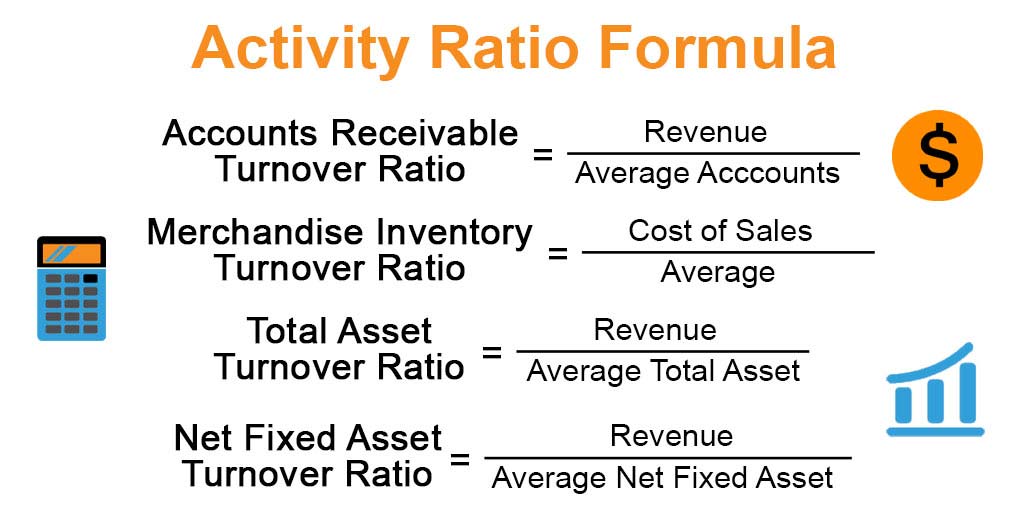

Asset Turnover Ratio Formula Calculator Excel Template

Departing Employees Annual Benefits.

. Payback Period Example Calculation. It measures how much cash a firm makes after deducting its needed working capital and capital expenditures CAPEX. You can use the following calculator-Net Sales.

Departing Employees Annual Basic Salary. Non-Cash Working Capital Turnover Ratio. You can also use our Receivable Turnover Ratio Calculator.

A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we get by dividing current assets by. Total yearly Basic Salary of the departing employee. Working Capital Current Assets Current Liabilities.

The receivables turnover ratio is an absolute figure normally between 2 to 6. We need to calculate Working Capital using Formula ie. Companies use a ratio of working capital to sales to see if the business.

Net Working Capital Assumptions. Home Working Capital Financing. Usually it is 20 of the basic salaryA formula has been inserted for the same.

First well calculate the metric under the non-discounted approach using the two assumptions below. Working capital is a critical concept in the world of finance. Average Net Fixed Assets.

For the working capital schedule and fixed assets forecast the following assumptions will be used. Get the Template. For the calculation of working capital the denominator is the working capital.

The x here is nothing but an inventory turnover ratio converted into a number of days instead of the number of times. Get the Calculator. Read more and eventually stock price.

It tells the analyst how many times a given account depletes and repletes within a fiscal period most often a year. The management needs to determine the right amount of investment. Working capital which is current assets minus current liabilities is a balance sheet item Balance Sheet Item Assets such as cash inventories accounts receivable investments prepaid expenses and fixed assets.

The idea of turnover is common in financial analysis. In this section you need to enter the following details. However companies that enjoy a high inventory turnover and do business on a cash basis require very little working capital.

Some people also choice to include the current portion of long-term debt in the liabilities section. Assuming an average inventory of 5000 and average sales of 18000. Interpretation of the Ratio.

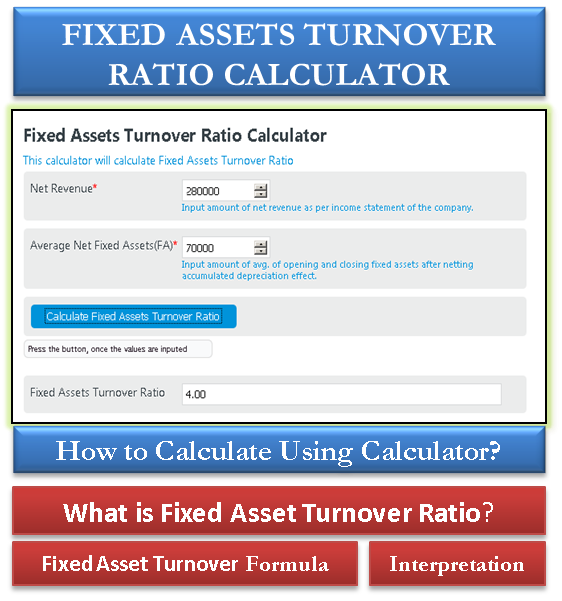

Fixed Asset Turnover Ratio Formula Calculator. Liabilities such as long-term debt short-term debt Accounts payable and so on are all. A receivable turnover ratio of 2 would give an average collection period of 6 Months 12 Months 2 and similarly 6 would give 2 Months 12 Months 6.

The meaning is quite clear. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short-term investmentsThe current liabilities section typically includes accounts payable accrued expenses and taxes customer deposits and other trade debt. 10mm Cash Flows Per Year.

Negative working capital on a balance sheet typically means a company is not sufficiently liquid to pay its bills for the next 12 months and sustain growth.

Activity Ratio Formula And Turnover Efficiency Metrics Excel Template

Working Capital Turnover Ratio Calculator

Activity Ratio Formula Calculator Example With Excel Template

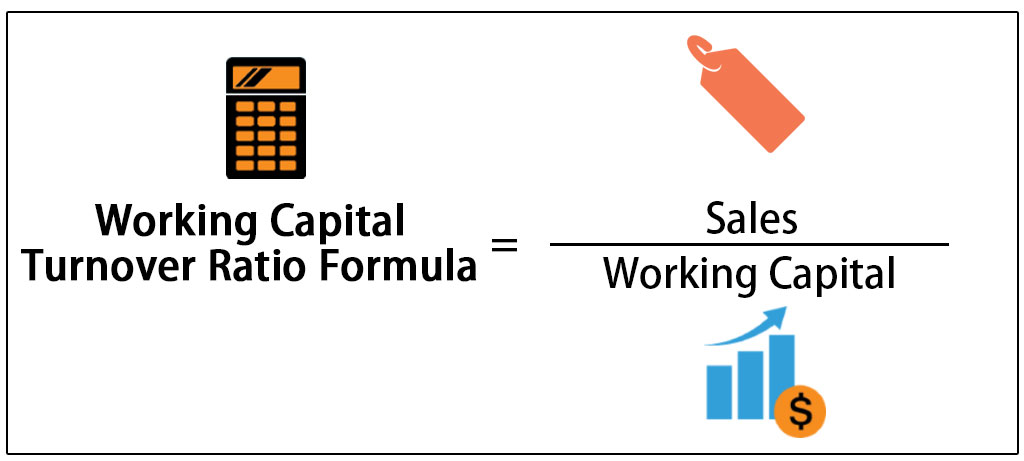

Working Capital Turnover Ratio Formula And Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Formula And Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Inventory Turnover Formula Analysis And Ratio Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Efficiency Ratios Archives Double Entry Bookkeeping

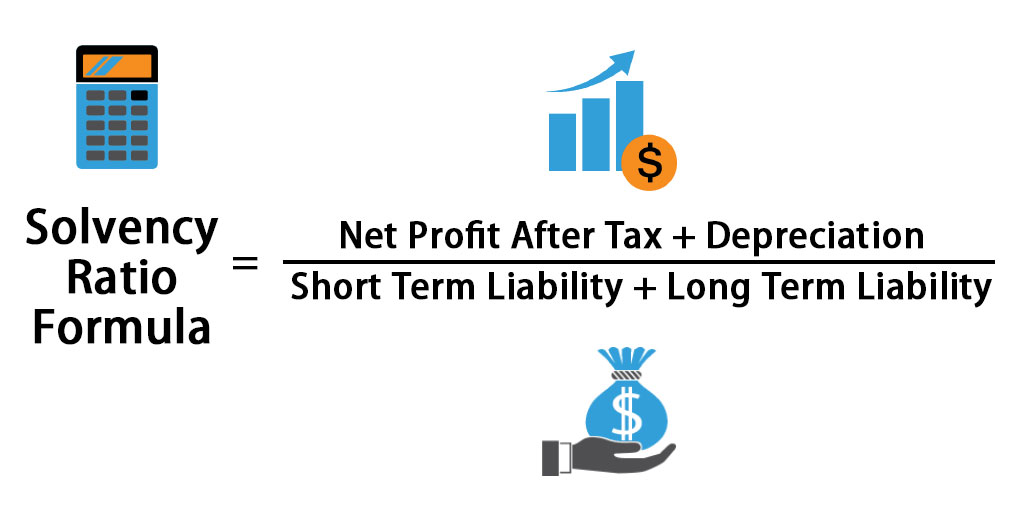

Solvency Ratio Formula Calculator Excel Template

Fixed Asset Turnover Ratio Calculator With Formula Interpretation Efm

How To Calculate Your Working Capital Turnover Ratio

Asset Turnover Ratio Formula And Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Updated 2022